Polyethylene (PE)

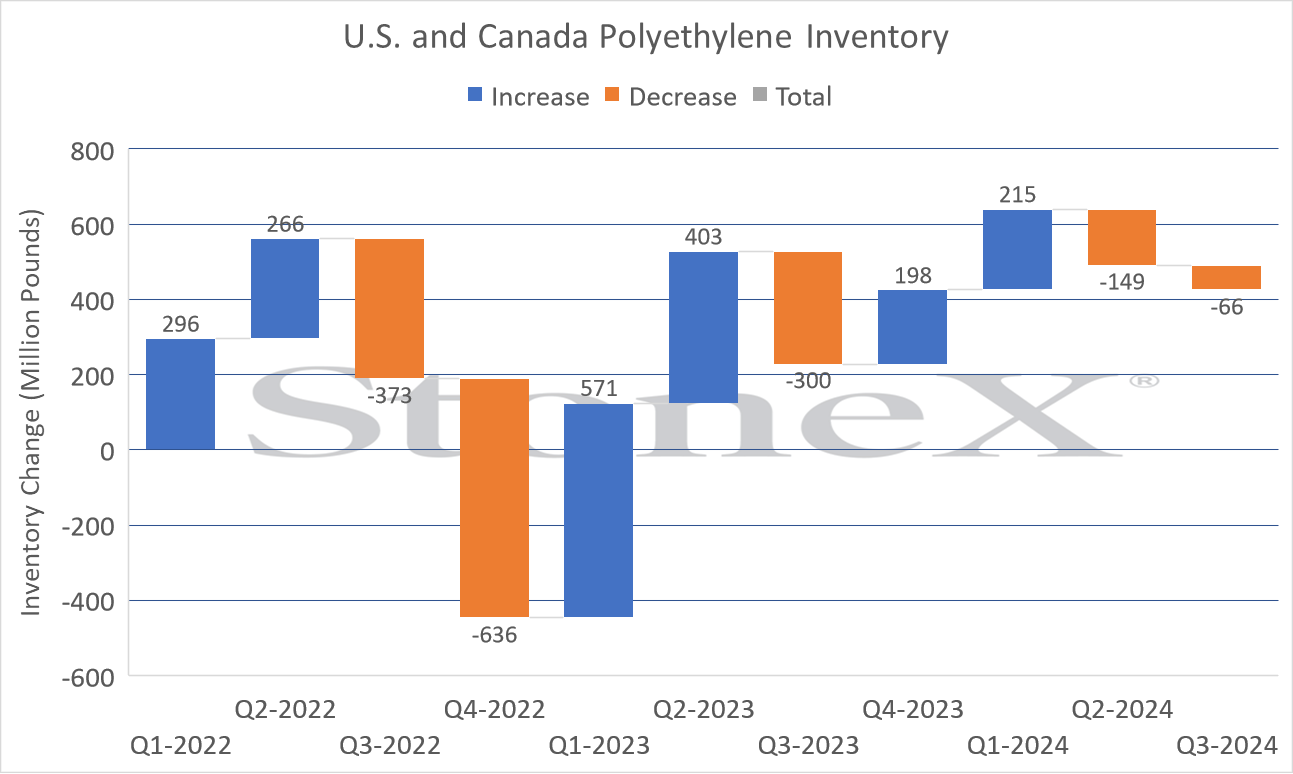

- PE prices settled flat on the month as supply continued to improve and suppliers have postponed their attempt at a 3 cpp raise in prices to April. Demand appears to be turning the corner and could provide more support for PE prices ahead.

- Ethane prices and natural gas prices have remained weak as we have ended the heating season in the U.S. PE producers are able to maintain strong margins as their input costs have remained soft.

Supply

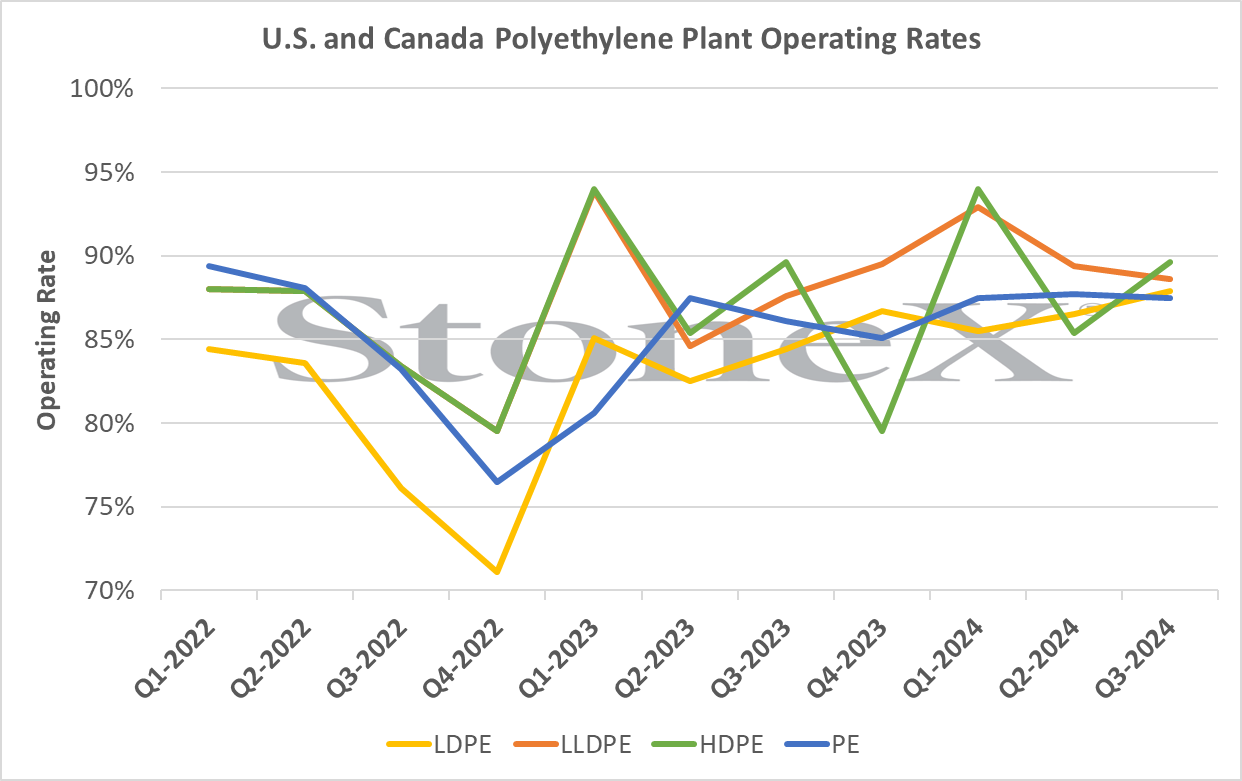

US polyethylene supply continues to improve. Effective plant operating rates are expected to be sustained at 90+% during the second quarter. In addition, there are fewer planned plant outages on the books for Q2. New capacity in North America has essentially been in start-up mode for several months, and the expectation is to see the impact of the additional production in the near term. Shell is running all three of their lines, while Baystar and NOVA continue ramping up their new capacity.

Demand

Year-to-date 2024 domestic demand in North America is strengthening, increasing at a rate more than 10% the first two months of the year. Exports are up over 30% YTD versus the same period in 2023. In addition, exports to Mexico were up 13%, while exports to the rest of the world were up 34% compared to 2023. Demand for HDPE blow-molding applications, the largest end-use segment, decreased 2.8% in February and is up 4.0% YTD versus 2023. Sales in the LLDPE film market, the largest end-use market for LLDPE were down in February, with sales in this segment up 5.0% in total YTD.

Data Source: American Chemistry Council, Chemical Market Analytics by OPIS

Data Source: American Chemistry Council, Chemical Market Analytics by OPIS

Feedstocks

Ethylene feedstock prices declined for most of March and trended lower toward the end of the month. Integrated margins for all PE grades increased from February to March thanks to lower ethane and natural gas prices. Low feedstock and energy costs will continue boosting margins in the North American PE industry during the first half of 2024. Integrated margins in April 2024 are expected to increase further if the 3.0 cent per pound increase in contract prices takes effect.

Price Outlook

US PE contract prices finally settled “flat” for the month of March after another month of extended negotiations. It is anticipated that several suppliers will seek to increase prices in April by at least 3.0 cents per pound. Producers will look to capitalize on current market conditions and take advantage of Red Sea supply chain issues that have elevated European prices. Feedstock and energy prices continue to favor US PE producers who are seeing some of the lowest production costs in years.

Polypropylene (PP)

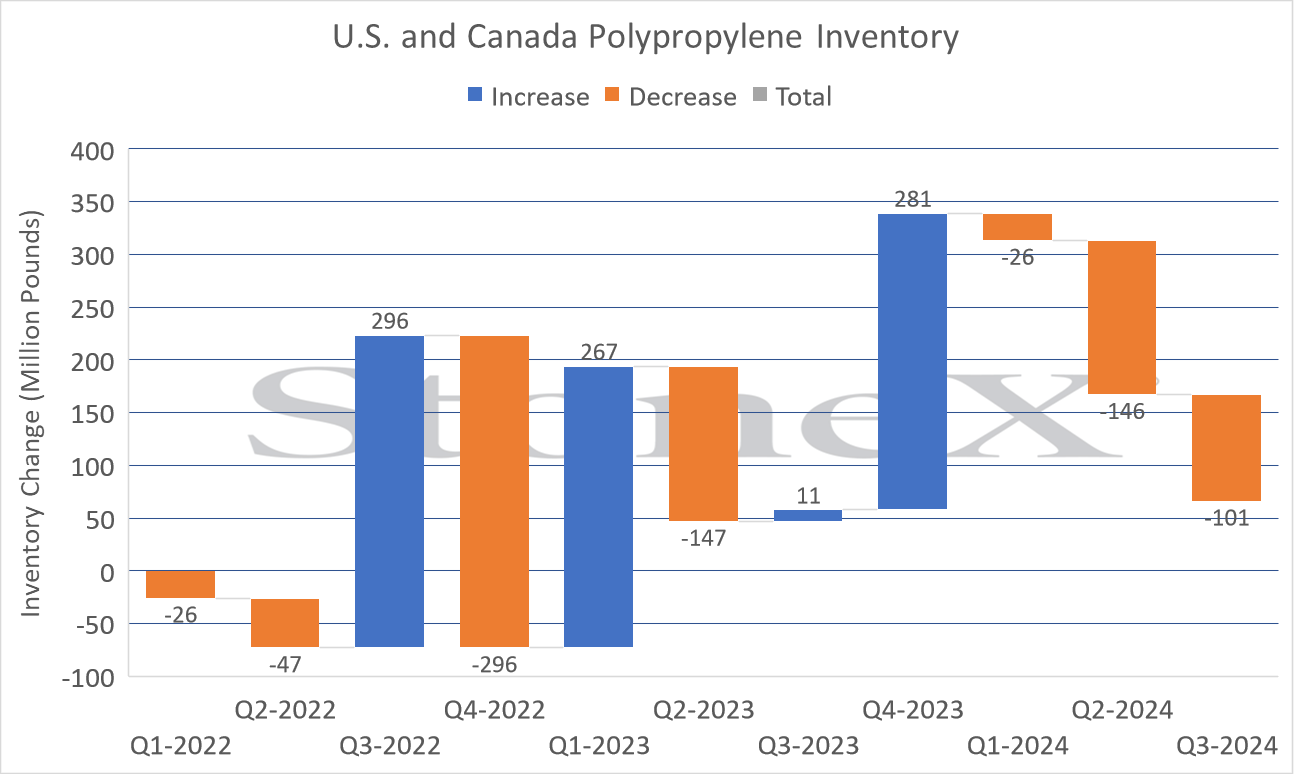

- PP supplies are expected to meet demand but demand appears to be recovering. Producers are expected to maintain discipline to prevent inventory build ups.

- Prices settled up 3 cpp in March, following PGP prices higher. A recent drop in PGP prices could mean PP prices follow suit in April. Expect prices to face downward pressure in the next month, even in the face of elevated crude oil prices.

Supply

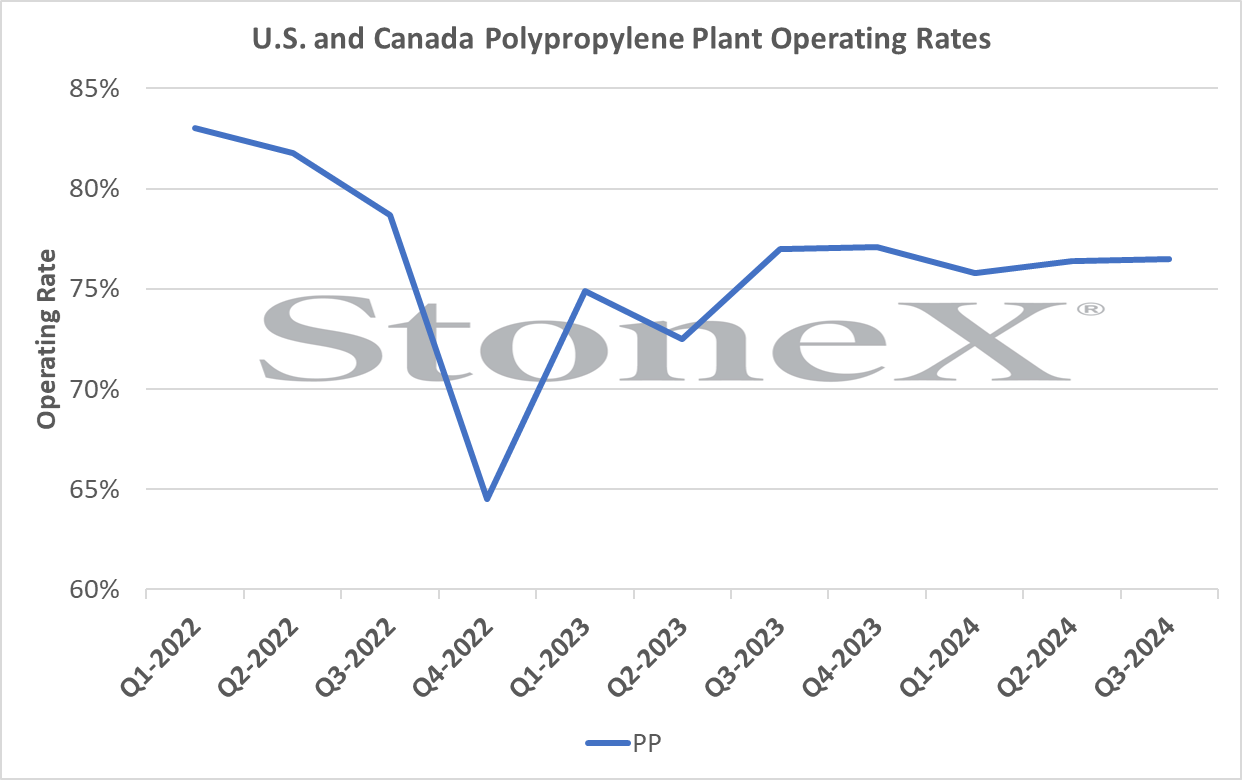

Planned PP plant outages are expected to increase starting in the second quarter. Given inventory days are just under 40 coupled with sustained low plant operating rates, it is anticipated that the supply should adequately meet demand. Producers are expected to keep operating rates low to prevent significant inventory buildup in the region in order to protect existing margins. February plant operating rates jumped over 82%, well ahead of the January operating rate of 68% and the strongest operating rate month since July 2022.

Demand

PP demand YTD February 2024 is ahead of the prior year by almost 10%. First quarter demand is expected to be much stronger than the prior year due to the high level of destocking seen in the first quarter of 2023. Distributors are off to a fast start, ahead of the same period in 2023 by 33%. Base demand levels have consecutively declined over the past two years, and 2024 is anticipated to be a year of recovery in demand to return to previous norms. Exports are expected to remain steady and potentially improve as US propylene prices become lower.

Data Source: American Chemistry Council, Chemical Market Analytics by OPIS

Data Source: American Chemistry Council, Chemical Market Analytics by OPIS

Feedstocks

US polymer-grade propylene prices have seen a drastic drop since mid-March, with propylene supply improving while demand stays relatively weak. Propylene prices are experiencing a double-digit drop in the spot market. This drastic correction in propylene prices improves the prospect of a modest increase in margins for PP producers. Many propylene producing units have completed planned maintenance that began in January. Some buyers are expecting an even bigger drop in propylene prices starting in April.

Price Outlook

North American polypropylene prices settled UP 3.0 cents per pound in March in line with a similar increase in polymer grade propylene (PGP). April PP prices are expected to decrease with spread/margin increases holding, offsetting declines in propylene price. Integrated producers have been able to export based on their refinery integration economics or their advantaged cost of propane. Non-integrated US PP producers have been unable to export as their cash costs have not been competitive with other regions.

Howard Rappaport is an independent consultant to the FCM Division of StoneX Financial Inc. (“SFI”) focusing on plastics market commentary. He does not have a personal futures trading account. All forecasting statements made within this material represent the opinions of the author unless otherwise noted.

The trading of derivatives such as futures, options, and swaps may not be suitable for all investors. Derivative trading involves substantial risk of loss, and you should fully understand those risks prior to trading. Past financial results are not necessarily indicative of future performance. All references to futures and options trading are made solely on behalf of SFI unless otherwise noted.

This material should be construed as market commentary, merely observing economic, political, and/or market conditions. It is not intended to refer to any particular trading strategy, promotional element or quality of service provided by StoneX Financial Inc.

SFI and its affiliates not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but it is not guaranteed as to its accuracy.

Factual information believed to reliable was used to formulate these statements of opinion; and SFI cannot guarantee the accuracy and completeness of the information being relied upon. These opinions are that of the author and do not necessarily reflect the viewpoints and trading strategies employed by SFI or its affiliates. All forecasts of market conditions are inherently subjective and speculative, and actual results and subsequent forecasts may vary significantly from these forecasts. No assurance or guarantee is made that these forecasts will be achieved.

Reproduction or use in any format without authorization is forbidden. All rights reserved.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.