- Consumer Price Index (CPI) in the US expected to maintain a trend of mild moderation in January, reinforcing the perception that the Federal Reserve is not likely to cut its key interest rate until May and strengthening the dollar.

- US retail sales in January may underscore the perception of a healthy economy and reinforce interpretations that the Federal Reserve will be cautious in carrying out its cycle of interest rate cuts this year, favoring the US interest rate differential and strengthening the dollar.

- Negotiations between the Executive and Legislative branches to resume progress on the economic agenda may involve postponing the payroll tax reapportionment measures, which could worsen the fiscal outlook for 2024 and raise the perception of fiscal risks for Brazilian assets, weakening the Brazilian real.

The week in review

The week was marked by the release of strong data for the US services sector, which reinforced the prospect that the Federal Reserve's interest rate cut cycle will start later in May or even June. In Brazil, the minutes of the latest Copom decision consolidated the outlook for cuts of 0.50 p.p. to the basic interest rate (Selic), even though services inflation may be slightly higher than expected by the Committee.

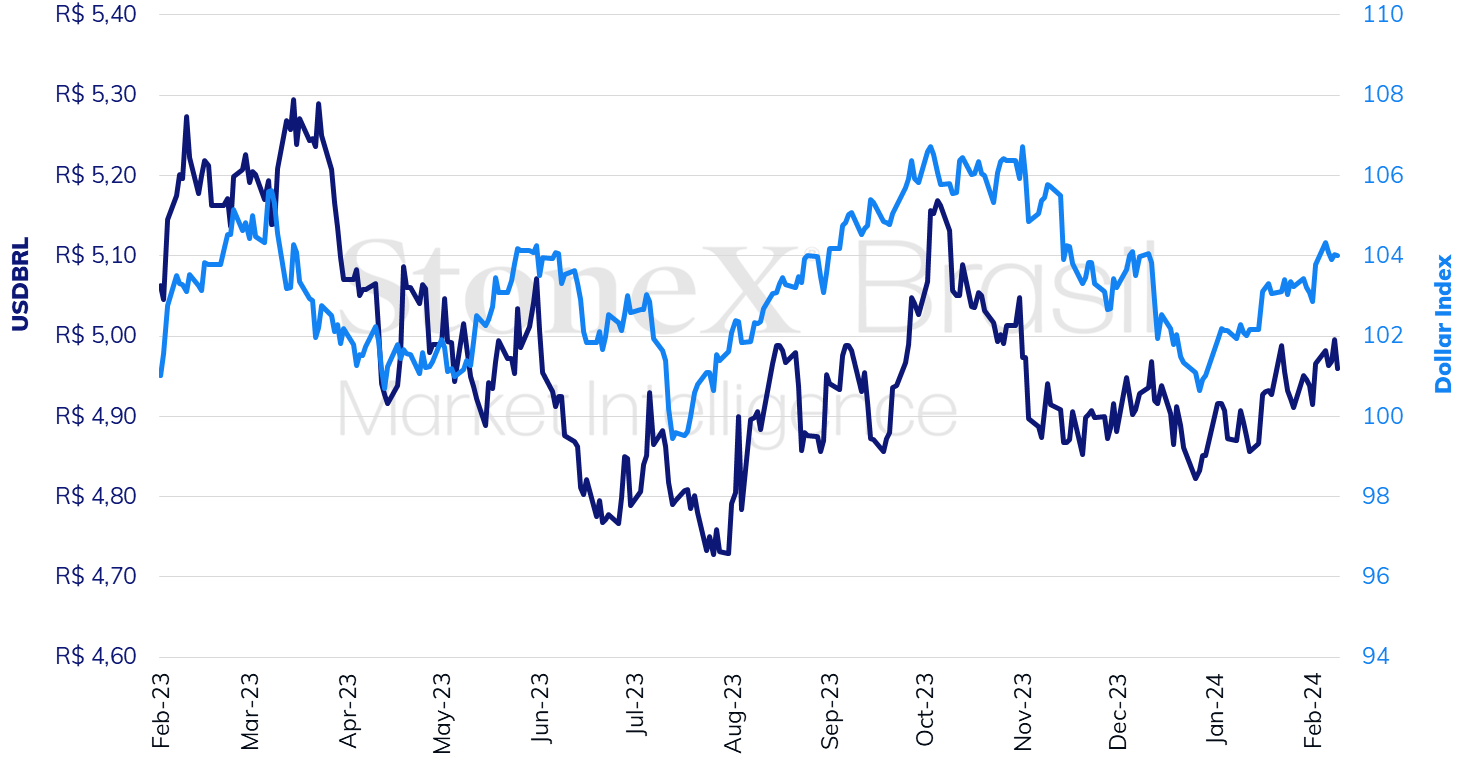

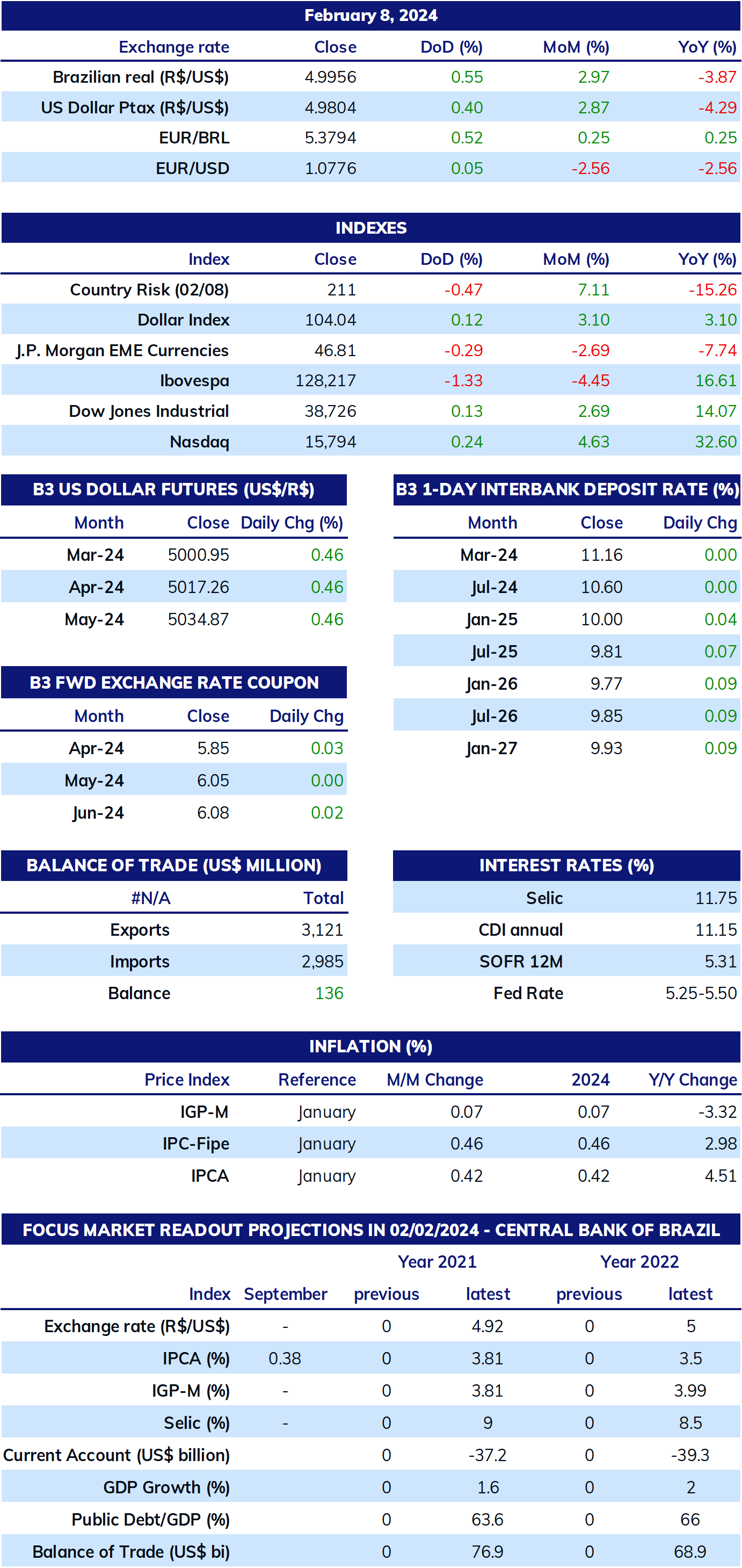

The dollar traded on the interbank market ended the week slightly down, closing Friday's session at BRL 4.960, a variation of -0.1% for the week, +0.4% for the month and +2.2% for the year. The dollar index closed Friday's trading session up for the sixth consecutive week, at 104.0 points, a weekly gain of 0.2%, a monthly gain of 0.9% and a yearly gain of 2.9%.

THE MOST IMPORTANT EVENT: US inflation

Expected impact on USDBRL: bullish

If, on the one hand, the data for productive activity and the labor market are exceeding analysts' estimates and signal a strengthening US economy, on the other, inflation data have remained relatively benign so far and indicate a trend of gradual price moderation. In fact, in the last monetary policy decision, Federal Reserve Chairman Jerome Powell said that the Federal Open Market Committee (FOMC) was not expecting better inflation readings to start a cycle of interest rate cuts, but only that the current moderation be confirmed for a few more months in order to boost the Committee's confidence in price stabilization. As a result, the Consumer Price Index (CPI) for January is expected to be very similar to that of December, with a rise of 0.2% in the headline indicator and 0.3% in its core, which excludes the volatile energy and food components. Accumulated growth over 12 months would rise from 3.4% in December to 3.1% for the headline index and from 3.9% to 3.7% over the same period for the core. If these projections are confirmed, they should reinforce the perception that the Federal Reserve will still keep interest rates stable in March and will not begin a cycle of interest rate cuts until May.

US retail sales

Expected impact on USDBRL: bullish

Retail sales are expected to lose momentum after December's strong rise, driven by sales related to the end-of-year festivities, but should continue to expand and signal that personal consumption in the US remains strong. Sales growth is expected to rise from 0.6% in December to 0.3% in January, while "core" sales, which exclude more volatile categories such as automobiles, building materials and fuel, are expected to rise from 0.4% in December to 0.2% in January.

Frictions between the Presidential Administration and Congress

Expected impact on the USDBRL: bullish

After the intense wear and tear caused by the Executive's initiatives with the Legislative branch during the parliamentary recess, such as issuing the Provisional Measure (MP) proposing the payroll tax hike and President Luiz Inácio Lula da Silva's veto of parliamentary committee amendments, the week was marked by conflicts, sharp public exchanges and canceled meetings. In search of an agreement, last Friday (09), President Lula met with the President of the Chamber of Deputies, Arthur Lira (PP-AL), and agreed that political articulation will no longer be led by the Minister of Institutional Relations, Alexandre Padilha, and will pass into the hands of the Civil House Minister, Rui Costa. In addition, the Ministry of Finance is negotiating with Congress on changes to the scope and timeframe of the payroll tax exemption, seeking a compromise and possibly even withdrawing the Provisional Measure and submitting instead a Bill as a matter of urgency, with a 45-day deadline for its analysis, with the new terms negotiated, which gives congressmen greater negotiating power compared to a Provisional Measure.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.