| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 5.33% | 5.31% | 4.91% | 4.62% | 4.62% | 4.61% | |

Huge week for the rates market, with a notable breakout from the 10-Year

-

We saw big swings in the rate market this week, with market moving reports and Fed speakers throughout. But volatility truly came to a crescendo this morning following the March jobs report

-

And these labor market reports just keep surprising to the upside. Remarkable to say the least

-

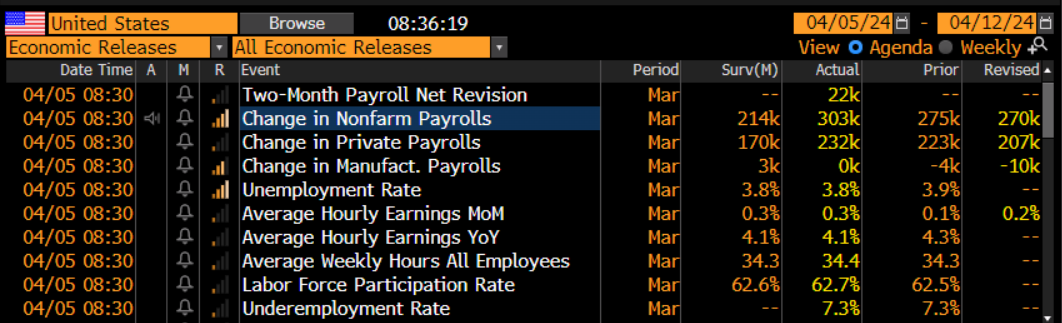

303,000 jobs added to the economy last month – well above the 214k estimate and February’s 270k

-

For some perspective: during the decade between 2008-2018, monthly job creations over 300k were seen just 10 times. Yet since 2021, we’ve eclipsed that level 20 times

-

-

The unemployment rate drops to 3.8% from 3.9% (now two years of sub 4% unemployment)

-

Wages rose 0.3% in March and 4.1% over the past 12 months, in-line with estimates, while February was revised higher to 0.2%

-

Lastly, the participation rate rose to 62.7% from February’s 62.5%

Source: Bloomberg

-

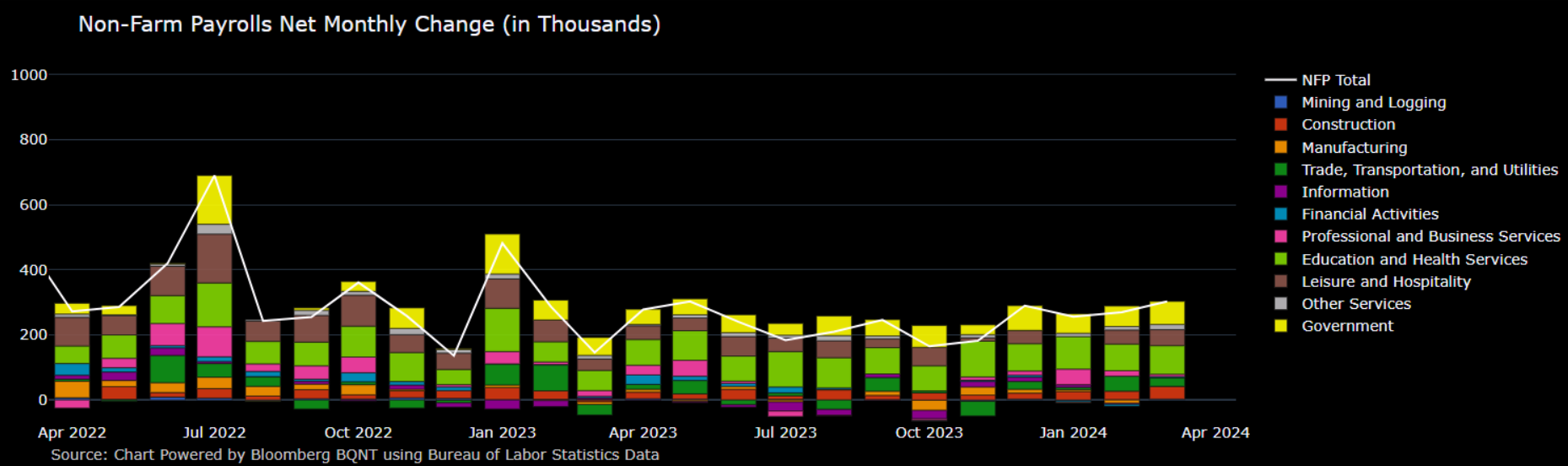

The job gains were broad, but the categories that added the most last month were Healthcare (+82k), Government (+71k), Leisure and Hospitality (+49k) and Construction (+39k). Meanwhile, Manufacturing jobs came in flat for the prior month with February revised 6k lower to a 10k loss in jobs (figures contrary to the ISM Manufacturing readings earlier this week that showed the industry expanding for the first time in years)

-

Average hourly earnings for all employees on private payrolls increased 12 cents to $34.69 (curious to see how California’s minimum wage increase to $20/hour for ~500,000 fast food workers will impact this number next month)

source: Bloomberg

-

Yesterday, Powell’s remarks at Stanford University were largely a rehash of the same things stated at the March FOMC meeting: The Fed is very much data-dependent…rate cuts will happen when there is enough confidence inflation is well under control…still on track for three cuts this year but will quickly react to a weakening labor market

-

But it raises the question: why commit to rate cuts at all? This morning’s report confirms just how strong the labor market is. Their dual mandate is faced with: 1) CPI stuck at 3.0% - 3.5% and 2) an expanding labor market, not a weakening one

-

The point of cutting interest rates is to provide support to the economy – but it seems like it’s doing just fine with 5.30% Fed Funds. Why dilute their dry power with cuts this summer if inflation improvements are slowing and the labor market doesn’t warrant a pivot?

-

At least Minneapolis Fed President, Neel Kashkari, is thinking about those rhetorical questions - commenting yesterday: "I wrote down two cuts in March, but possible the Fed won't cut this year if inflation stalls”

-

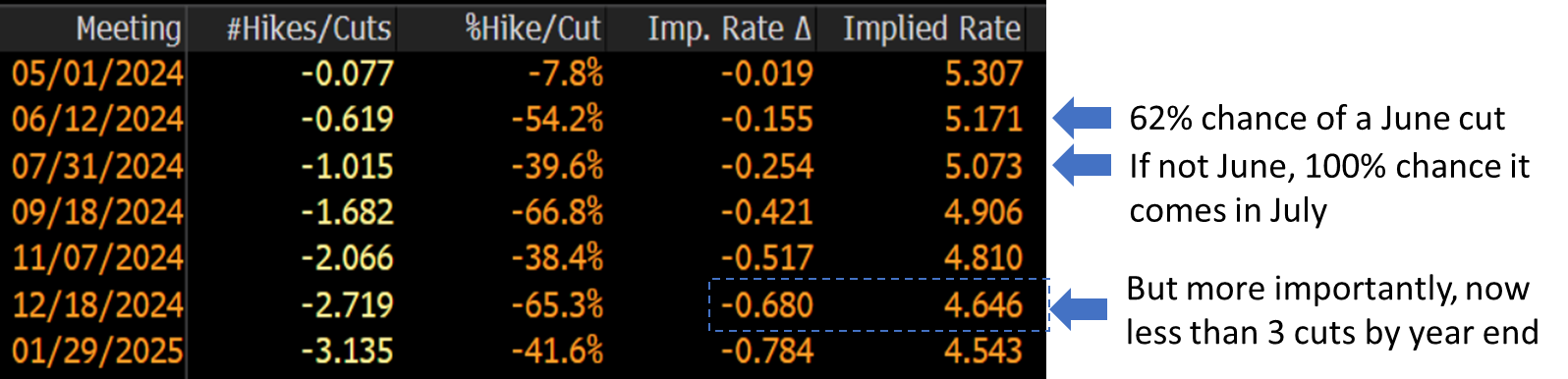

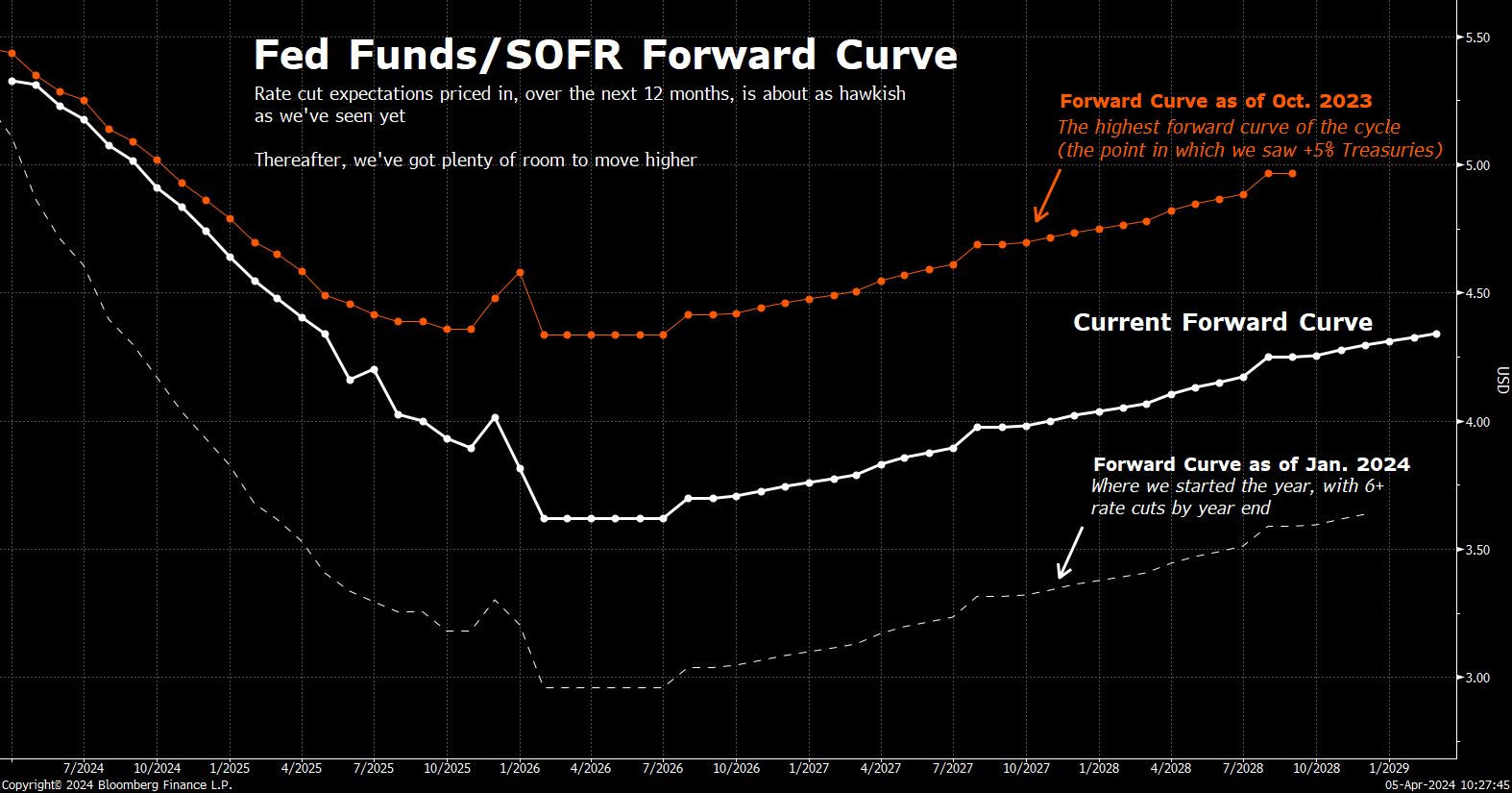

The market seems to be coming around to that very same question too – with the forward curve now repricing what a cutting cycle may look like

-

Less than 3 cuts by year end – more hawkish than the Fed’s own forecast

-

The first one by July (maybe June) – unchanged

-

But the new development being where the market expects the Fed to stop cutting – now much higher and sooner than previously thought

-

source: bloomberg

-

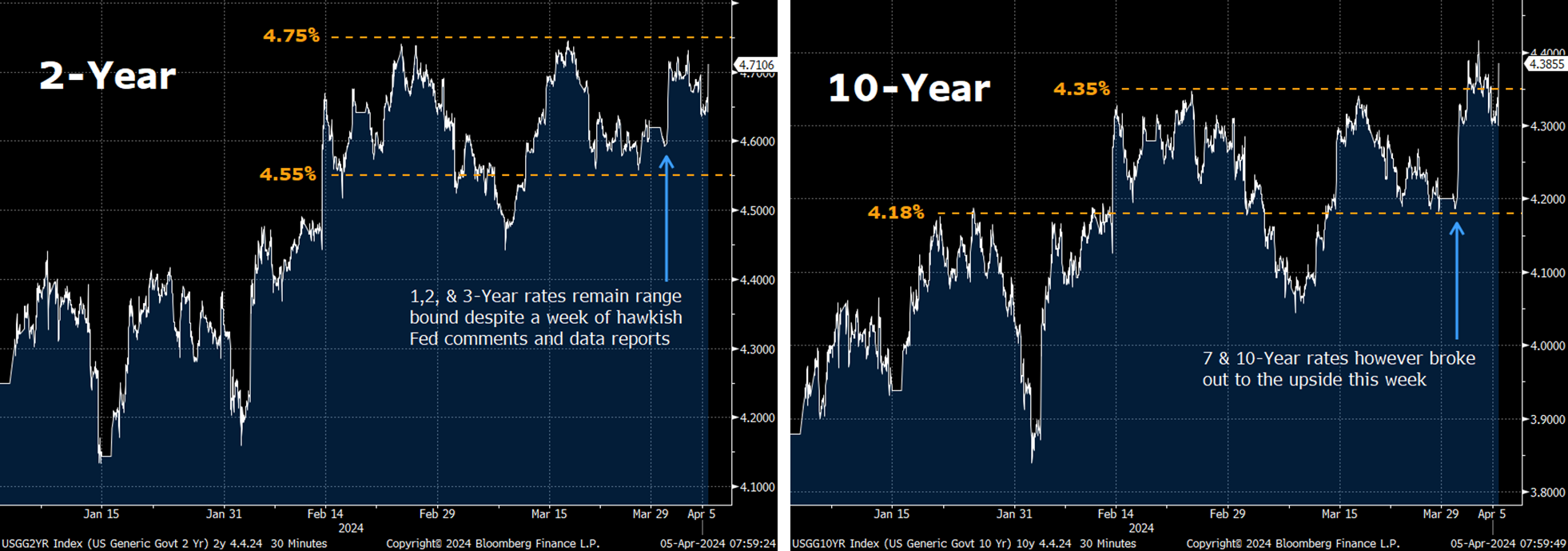

The repricing of the curve is lifting rates – but notably on the long end

-

2-Year rates are struggling to breakout of their range, but 5,7 & 10-Year rates are breaking out to the upside

-

Source: bloomberg

The move higher in frontend rates looks almost exhausted given the pace of cuts now priced in, but the belly and long end could have more room to run

-

The forward curve has repriced the pace of near-term rate cuts at almost the same extent as we saw during the most hawkish curve of the cycle (back when Treasuries across the curve hit +5%)

-

And because of this, 1 & 2-year rates may find it difficult to breakout above 4.75% and continue to trade range bound

-

Yet further out, upside risks remain as the market tries to understand what it would mean if the Fed only cut rates a few times before stopping

-

If the labor market doesn’t force emergency cuts, and inflation just meanders down to 2-2.5%, a cutting cycle may end up being short and sweet – a tailwind to support higher yields on the long end of the curve and very plausible we see the 10-year Treasury looking at 4.50% again

source: bloomberg

Covered calls

-

If the last two Fed meetings has taught us anything, it’s that despite marginal increases to inflation and/or strong labor markets, returning to rate hikes is off the table

-

Instead, we could be looking at a Fed that may elect to hold longer in response to inflationary data

-

So, selling a covered call is shaping up to look like a nice way to take advantage of this jump in rates

-

Consider striking it somewhere above current 5.31% SOFR as to not impact monthly settlements

-

Directionally, the cap’s Dv01 offsets the swap to some degree, but leaves room for it’s MTM to continue benefiting should futures rise from here

-

Collect the option premium upfront – amounts now worth looking at given the repricing of the curve and volatility baked in

-

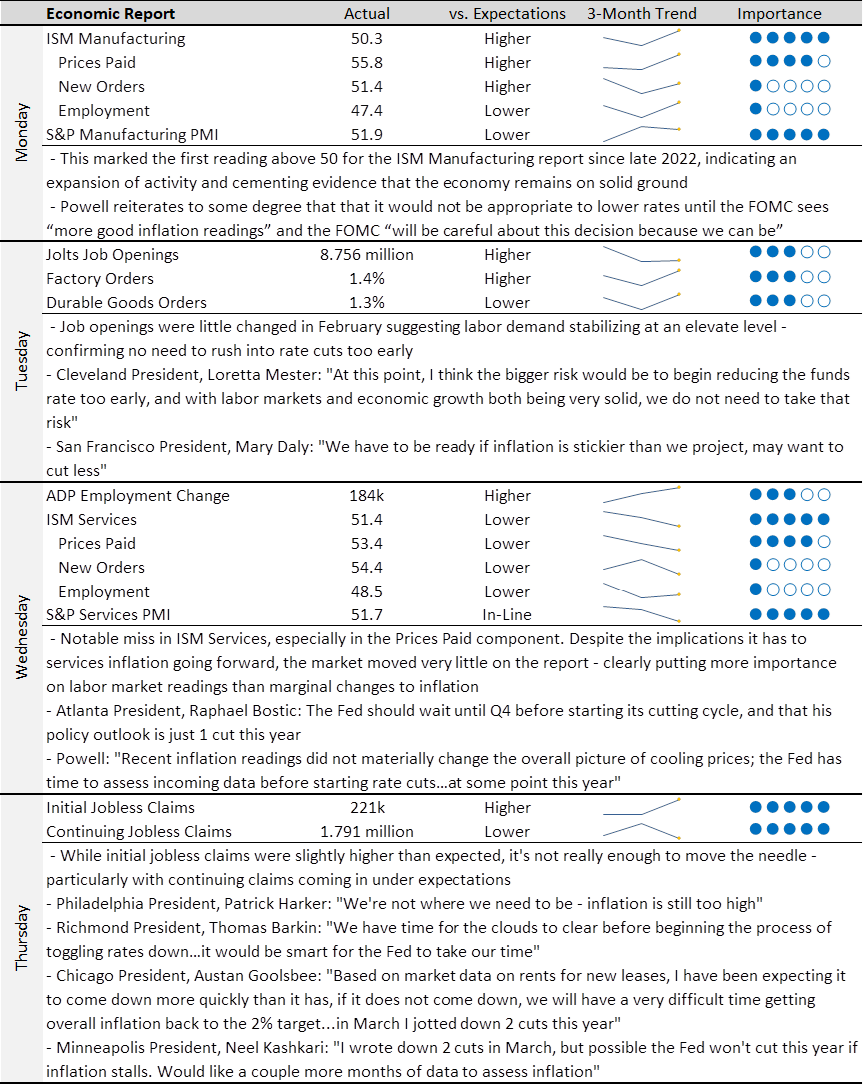

This week's Play-by-play

source: bloomberg/stonex

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.